AI is transforming how businesses manage audit trails, making the process faster, more accurate, and less prone to errors. Traditional methods often rely on scattered systems and manual sampling, which can miss risks and increase compliance challenges. AI tools now offer real-time monitoring, full data analysis, and automated compliance tracking, solving these issues.

Key Benefits of AI in Audit Trail Management:

- Real-Time Monitoring: Detects anomalies and risks instantly instead of waiting for periodic reviews.

- Full Data Analysis: Analyzes 100% of transactions, eliminating gaps caused by sampling.

- Fraud Detection: Identifies subtle patterns and irregularities that manual processes might miss.

- Compliance Automation: Simplifies adherence to standards like SOX, GAAP, and IFRS.

Top Platforms:

- Safebooks AI: Focuses on real-time monitoring, fraud detection, and compliance automation across financial systems.

- TrustCloud AI: Centralizes data from multiple sources, offering continuous compliance and behavioral risk analysis.

- Smart Audits AI: Delivers precise fraud detection using advanced AI techniques like machine learning and LLMs.

AI tools not only streamline audit processes but also help businesses stay ahead of compliance requirements while reducing costs. However, human oversight remains essential to interpret findings and ensure reliability.

Agentic AI: Autonomous Decision Making

1. Safebooks AI

Safebooks AI is reshaping how audit trails are managed by analyzing all financial transactions across various systems like ERP, billing, payroll, and CRM. This approach ensures full transaction coverage, giving finance teams complete confidence in their data. Unlike traditional methods that rely on random sampling, Safebooks AI offers a comprehensive view, enabling better fraud detection, real-time insights, and automated compliance.

Real-Time Detection Speed

Instead of waiting for retrospective audits, Safebooks AI provides continuous, real-time monitoring. It flags issues like revenue discrepancies, unauthorized access, or unusual journal entries as they happen. This means finance teams can intervene to prevent problems such as duplicate expense reimbursements or unauthorized payouts before they occur. By spreading auditing tasks throughout the month, the platform eliminates the chaotic rush at the end of reporting periods, reducing the chance of errors.

Fraud Prevention Accuracy

Using advanced machine learning, Safebooks AI identifies subtle signs of fraud that might escape human notice. This is particularly important given that over 50% of occupational fraud stems from weak or overridden internal controls. The platform performs cross-system reconciliations, identifying mismatches between source systems and the general ledger. The result? A fully reconciled digital audit trail that traces every transaction back to its origin.

Compliance Automation Levels

Safebooks AI simplifies compliance by automating internal controls aligned with frameworks like SOX, ICFR, and COSO. It generates audit-ready workpapers in minutes, and the system can be up and running in less than a week. CEO Ahikam Kaufman underscores the importance of this technology, especially for smaller and mid-sized firms:

With the PCAOB placing greater emphasis on data integrity and technology-driven analysis, smaller and mid-market firms need to prioritize enhancing their internal controls... to align with these new standards.

2. TrustCloud AI

TrustCloud AI shifts the focus from periodic compliance checks to continuous compliance automation. By connecting to over 100 cloud and on-premises sources via a hybrid data fabric, it creates a centralized GRC (Governance, Risk, and Compliance) data lake. This unified system normalizes all incoming data, keeping audit trails up-to-date across every system, whether it’s access logs or transaction records. This centralized approach supports its continuous monitoring and advanced analytics.

Real-Time Detection Speed

TrustCloud AI uses adaptive machine learning to establish a behavioral baseline for each organization. This enables it to instantly detect subtle anomalies, policy violations, or control failures in transactions and user activities. Unlike traditional audits that review financial activities long after the fact, TrustCloud AI flags unusual behaviors - like unauthorized access or irregular spending patterns - right as they happen. This proactive approach ensures faster responses to potential issues.

Comprehensive Data Coverage

Traditional manual audits often rely on sampling, which can miss critical details. TrustCloud AI, on the other hand, integrates and validates all data from both cloud and on-premises sources. By analyzing 100% of the data, it condenses what would typically take days into just hours. This exhaustive coverage allows the platform to uncover hidden patterns and discrepancies that manual processes might overlook.

Advanced Fraud Prevention

TrustCloud AI enhances its oversight with advanced fraud detection techniques. Its "Assurance AI" employs natural language processing (NLP) and sophisticated retrieval methods to minimize errors. According to TrustCloud, the platform ensures "error-resistant workflows while keeping your data confidential and secure... trained on a large data set of security and GRC data to prevent hallucinations". Before processing, the system rigorously cleans and standardizes data to ensure that inconsistencies don’t affect results. Every action is logged in a digital audit trail, strengthening governance and accountability.

Streamlined Compliance Automation

With its "test once, satisfy many" strategy, TrustCloud AI helps organizations meet multiple regulatory standards and custom frameworks simultaneously. It automates hundreds of security assurance workflows while adhering to governance standards like ISO 42001 and the NIST AI Risk Management Framework (RMF). This continuous real-time compliance monitoring eliminates the need for last-minute scrambling before external audits, keeping organizations audit-ready at all times.

sbb-itb-bec6a7e

3. Smart Audits AI

Smart Audits AI takes auditing to the next level by focusing on full-population testing and real-time anomaly detection. Unlike earlier solutions that relied on sampling or periodic checks, this platform analyzes 100% of transactional data across ledgers and audit trails. By shifting toward comprehensive and continuous monitoring, it delivers unmatched precision in audits.

Real-Time Detection Speed

This platform doesn't miss a beat. Smart Audits AI tracks every system action in real time, offering instant alerts and uninterrupted visibility into audit trails. Using machine learning, it pinpoints unusual patterns and potential threats before they can cause harm. This proactive approach eliminates the delays that come with manual, after-the-fact reviews.

Coverage Percentage

Forget about sampling errors. Smart Audits AI examines every single transaction, ensuring no stone is left unturned. By covering the entire data set, it minimizes the chance of missing anomalies, even those that are rare or highly sophisticated. This comprehensive approach strengthens oversight and leaves little room for fraudulent activities to slip through.

Fraud Prevention Accuracy

Fraud detection becomes sharper with Smart Audits AI. By analyzing vast amounts of financial data, the platform uncovers complex trends and enables proactive risk management. It leverages computer vision for feature extraction and Large Language Models (LLMs) to classify text, making it easier to identify suspicious behaviors. Beyond detection, advanced AI systems can sense risks, take action, and manage workflows in real time, going far beyond the limitations of traditional point-in-time testing.

Compliance Automation Levels

Smart Audits AI transforms compliance efforts by moving from periodic reviews to continuous monitoring. The platform evaluates changes against compliance rules as they happen, capturing and storing activity documentation automatically. Each action is linked to the appropriate compliance requirements, keeping organizations audit-ready without the heavy manual workload typically associated with regulatory reviews. This streamlined process not only saves time but also ensures a higher level of preparedness.

Pros and Cons

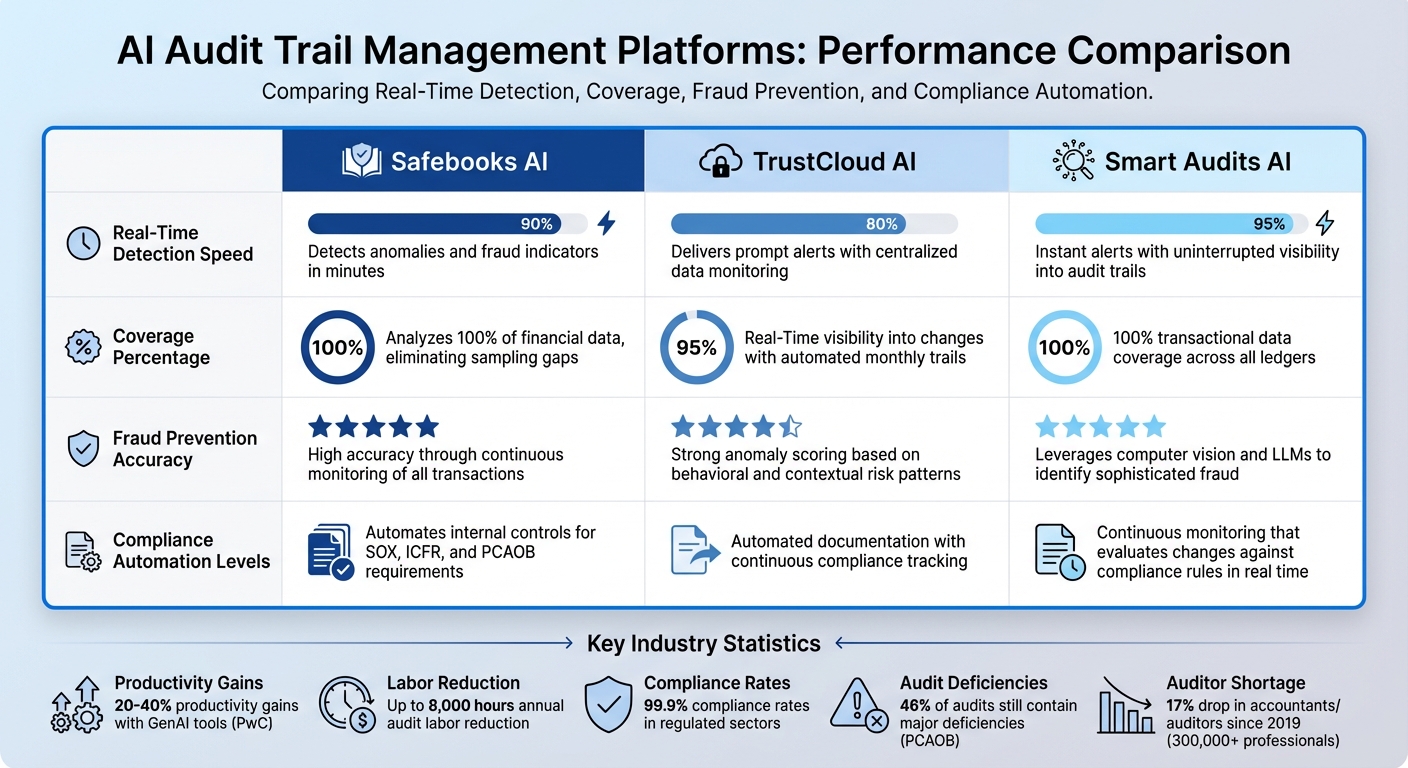

AI Audit Trail Management Platforms Comparison: Safebooks vs TrustCloud vs Smart Audits

After diving into detailed reviews of these platforms, here's a snapshot of how they stack up across key performance metrics. Use this breakdown to weigh their strengths and weaknesses and find the best match for your needs.

| Platform | Real-Time Detection Speed | Coverage Percentage | Fraud Prevention Accuracy | Compliance Automation Levels |

|---|---|---|---|---|

| Safebooks AI | Detects anomalies and fraud indicators in minutes | Analyzes 100% of financial data, eliminating sampling gaps | High accuracy through continuous monitoring of all transactions | Automates internal controls for SOX, ICFR, and PCAOB requirements |

| TrustCloud AI | Delivers prompt alerts with centralized data monitoring | Real-time visibility into changes with automated monthly trails | Strong anomaly scoring based on behavioral and contextual risk patterns | Automated documentation with continuous compliance tracking |

| Smart Audits AI | Instant alerts with uninterrupted visibility into audit trails | 100% transactional data coverage across all ledgers | Leverages computer vision and LLMs to identify sophisticated fraud | Continuous monitoring that evaluates changes against compliance rules in real time |

By shifting from manual sampling to full-population testing, these AI platforms are transforming audit processes, enhancing both accuracy and efficiency. Leading firms like KPMG, PwC, and Deloitte are leveraging AI tools to scrutinize every transaction, including those that might otherwise go unnoticed, like weekend entries or amounts just below approval thresholds. PwC reports that audit teams using GenAI tools regularly see productivity gains of 20-40%. One pilot program at a financial institution even found that AI could cut audit labor by up to 8,000 hours annually.

That said, human oversight remains critical. While AI can pinpoint anomalies with precision, experienced auditors are needed to interpret findings and make final decisions. A recent PCAOB review revealed that 46% of audits still contained major deficiencies, emphasizing the need for a hybrid approach that combines AI-driven insights with professional judgment.

The stakes are even higher given the profession's challenges: since 2019, there’s been a 17% drop in accountants and auditors, with over 300,000 professionals leaving the field. AI tools are stepping in to help manage these operational pressures while maintaining high audit standards.

Each platform brings something distinct to the table. Smart Audits AI stands out for its advanced fraud prevention capabilities, using cutting-edge tools like computer vision and LLMs. Safebooks AI shines in automating compliance frameworks, and TrustCloud AI offers a strong mix of behavioral analysis and streamlined reporting.

Conclusion

AI is transforming audit trail management by shifting the focus from manual, after-the-fact reviews to real-time monitoring that identifies anomalies as they happen. This evolution - from periodic sampling to continuous oversight - enables organizations to analyze financial data more effectively, without increasing staff or error rates. Automated tools for evidence collection and reconciliation now resolve discrepancies instantly, replacing chaotic manual processes with systems that are always audit-ready.

When adopting AI for audit purposes, look for tools that provide continuous monitoring, advanced fraud detection, and automated compliance tracking. Human oversight remains essential to interpret anomalies and handle exceptions. Before implementation, ensure you map all data sources - such as petty cash accounts or subscription platforms - and update AI connections within 24 hours when integrating new payment systems. These steps are key to building a proactive approach to audit readiness.

"Maintaining human review in the AI lifecycle where possible and being transparent with stakeholders about where and how AI is being used are two pillars of reliability and trustworthiness." - Deloitte

Opt for tools with pre-configured connectors for cloud platforms like AWS and Azure, allowing you to get up and running in hours rather than months. To keep your system accurate and aligned with evolving vendors and spending patterns, retrain AI models quarterly using recent transaction data. For those exploring AI solutions tailored to audit and compliance, AI for Businesses (https://aiforbusinesses.com) is a helpful resource for comparing tools that can revolutionize your audit processes.

Proven AI systems in regulated sectors report compliance rates as high as 99.9%. As described, integrating these tools not only improves efficiency but also reinforces compliance standards. Success depends on clear governance, strong data quality, and a thoughtful balance of automation and human oversight.

FAQs

How does AI enhance fraud detection in audit trails?

AI is transforming fraud detection in audit trails by processing massive datasets with speed and precision. This capability helps businesses spot unusual patterns or anomalies that could signal fraudulent activities - something that manual methods might miss entirely.

By leveraging real-time monitoring and advanced analytics, AI tools go a step further, enabling organizations to detect potential threats before they grow into bigger problems. Beyond just improving compliance, these tools streamline operations by automating repetitive tasks and reducing the chances of human error.

How do Safebooks AI, TrustCloud AI, and Smart Audits AI differ in managing audit trails?

Safebooks AI, TrustCloud AI, and Smart Audits AI each bring a specialized focus to audit trail management and compliance automation.

Safebooks AI is all about financial data governance. It uses AI to monitor and detect anomalies, uncover potential fraud, and flag inaccuracies in real-time. This ensures accurate reporting and helps maintain ongoing compliance with financial regulations.

TrustCloud AI takes the lead in compliance tracking and ethical AI governance. It focuses on bias detection and creating transparent audit trails, making it a strong choice for organizations prioritizing regulatory adherence and ethical standards.

Smart Audits AI simplifies audit workflows by automating tasks such as scheduling, reporting, and risk assessment. This automation enhances efficiency and improves internal audit processes.

Each of these tools has its strengths: Safebooks AI ensures financial accuracy, TrustCloud AI champions transparency and compliance, and Smart Audits AI optimizes operational efficiency in audit management.

Why is human involvement crucial in AI-powered audit processes?

AI tools are fantastic at crunching massive datasets and spotting patterns that might otherwise go unnoticed. But here's the thing: they can't replace human judgment. Humans bring critical thinking and contextual awareness - qualities that machines can't replicate.

For example, while AI might flag a transaction as unusual based on data patterns, it takes a person to determine whether it's a genuine issue or just an outlier due to unique circumstances. Humans also play a key role in validating AI findings and making decisions that align with ethical and regulatory standards.

By blending AI's speed and precision with human insight, businesses can take their audit processes to the next level. The result? Audits that are not only accurate and reliable but also flexible enough to handle the messy, unpredictable nature of real-world scenarios.